Starting from July 1, 2025, Decree No. 117/2025/NĐ-CP on tax administration for business activities conducted via e-commerce platforms and digital platforms by households and individuals officially comes into effect. This decree introduces major changes to how taxes are managed for household businesses and individuals selling goods and services through such platforms. DNP Viet Nam Law Firm summarizes the key highlights as follows:

1. E-commerce platforms with payment functions must withhold and pay taxes on behalf of sellers

(Article 4, Decree No. 117/2025/NĐ-CP)

| Content | Before July 1, 2025 | From July 1, 2025 |

|---|---|---|

| E-commerce platforms with payment functionality (e.g., Shopee, Lazada…) | No responsibility for tax collection | Must withhold and pay VAT and PIT on behalf of sellers |

| Individuals / Household businesses | Self-declared and paid tax on total revenue | No need to declare the portion already withheld and paid by the platform |

2. Taxes are withheld at a fixed percentage at the time of payment

(Clause 1, Article 5, Decree No. 117/2025/NĐ-CP)

| Transaction Type | VAT | Personal Income Tax (for resident individuals) | Time of Withholding |

|---|---|---|---|

| Sale of goods | 1% | 0.5% | Upon completion of transaction and fund receipt by the platform |

| Service provision | 5% | 2% | Same as above |

| Transportation or service tied to goods | 3% | 1.5% | Same as above |

Example: A product sold for VND 10 million → platform withholds VND 150,000 in taxes (VAT + PIT), and the seller receives VND 9.85 million.

The image is designed by DNP Viet Nam Law Firm

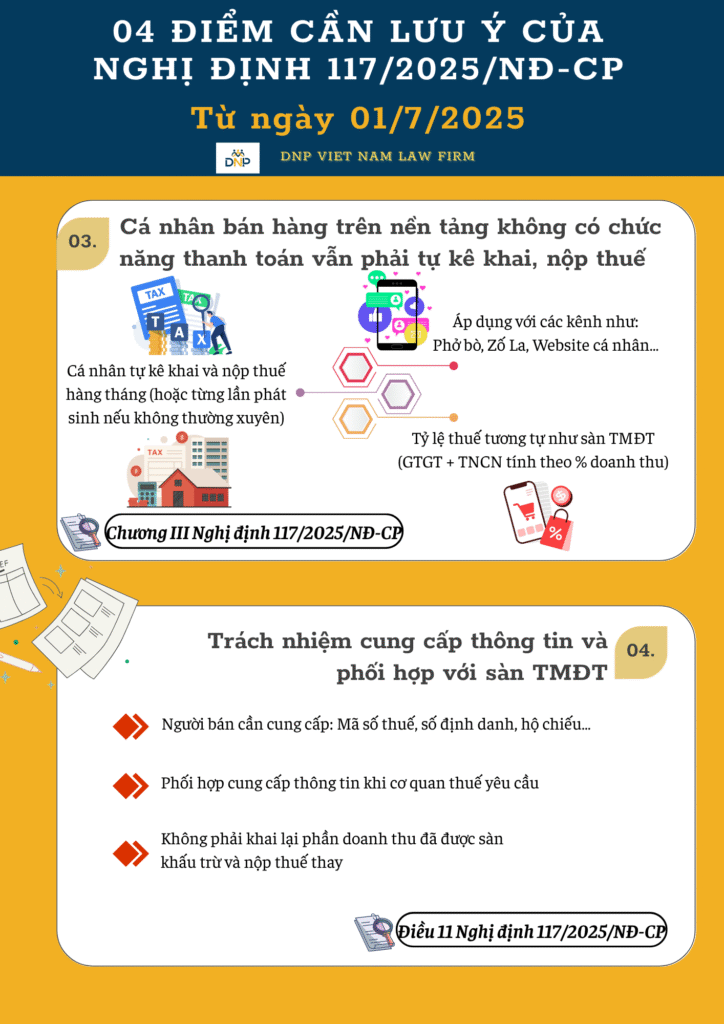

3. Individuals selling on platforms without payment functionality must still self-declare and pay taxes

(Chapter III, Decree No. 117/2025/NĐ-CP)

- Applies to channels like Facebook, Zalo, personal websites, etc.

- Individuals must self-declare and pay taxes monthly, or per transaction if not frequent.

- Tax rates are the same as those applied to e-commerce platforms (VAT + PIT calculated as a % of revenue).

4. Obligation to provide information and coordinate with e-commerce platforms

(Article 11, Decree No. 117/2025/NĐ-CP)

- Sellers must provide: Tax code, personal ID number, passport, etc.

- Cooperate to provide information when required by tax authorities.

- No need to declare revenue already withheld and paid by the platform.

Decree No. 117/2025/NĐ-CP introduces a mechanism for automatic tax withholding via e-commerce platforms, which helps simplify tax obligations for sellers. However, individuals doing business outside platforms with integrated payment systems must still proactively declare and pay taxes in compliance with the law.

——————————————————–

DNP VIET NAM LAW FIRM

Contact:

🏢 Address: 5th Floor, 52 Nguyen Thi Nhung Street, Van Phuc estate, Hiep Binh Phuoc, Thu Duc City, Ho Chi Minh City, Viet Nam.

📩 Email: info@dnp-law.com.

📞 Hotline: 0987 290 273 (Đinh Văn Tuấn Lawyer).

Website: https://www.dnp-law.com.